20 July 2023 • 16 minute read

Screening of foreign direct investments: Luxembourg's balancing act with FDI Regulation

On 13 June 2023, the Chamber of Deputies of Luxembourg adopted the bill of law n°7885 (the Bill) implementing Regulation (EU) 2019/452 of the European Parliament and of the Council of 19 March 2019 establishing a framework for screening foreign direct investments (FDI) into the EU (the FDI Regulation). The Bill will enter into force on 1 September 2023. Luxembourg is now one of dozens of countries that have implemented an FDI screening mechanism.

What is a foreign direct investment (FDI)?

The Bill defines a foreign direct investment as an investment:

- of any kind;

- made by an individual or a legal person which is neither based in an EU Member State nor in a country which is a party to the European Economic Area (EEA), acting either individually or in concert;

- which aims to create or maintain lasting and stable and direct relationships between the foreign investor and the Luxembourg entity to which the funds are sent; and

- enabling the foreign investor to effectively participate in the control of the entity which exercises a critical activity.

What are the objectives of the FDI Regulation and the Bill?

The objectives of the FDI Regulation are to protect EU Member States from foreign investments (ie investments from outside the EU) that could affect the country’s security, public order and interests. It also creates a cooperation mechanism between Member States.

Under the FDI Regulation, each Member State has the responsibility to implement its own mechanism to achieve the objectives of the FDI Regulation. In Luxembourg the Bill implements a screening mechanism relating to FDI and defines the sectors that fall within the screening mechanism.

FDI is critical to the global economy and one of the main catalysts for economic and social development. It can boost growth, create jobs and increase innovation.

This is particularly true for Luxembourg. Because of its size, the country has an eco-system that strongly relies on foreign investments and is a major platform for non-EU investors to access European markets. The challenge of the Bill was to find a balance between the framework set by the FDI Regulation and the desire to remain attractive for non-EU investors.

In Luxembourg, the Bill aims to mitigate the risks associated with FDI by screening investments. It involves screening investments where foreign investors could take control over an entity and which might harm public order and security. This could include investments made to gain access and significant influence over technologies, information, assets or services that are essential to state security.

In addition to this screening mechanism, the FDI Regulation creates a mechanism for intra-European cooperation, enabling the exchange of information and concerns regarding FDI. The FDI Regulation enables Member States to contact other Member States when investments could potentially damage their strategic interests. The Ministry of Foreign and European Affairs is the national authority in charge of coordination in Luxembourg.

What investments fall within the scope of the Bill?

The Bill applies to investments of any kind made by a non-EU investor aiming to establish or maintain lasting and stable relationships with an entity governed by the laws of Luxembourg when the investment relates to a critical sector in Luxembourg. It applies when the investment would enable the investor to, directly or indirectly:

- have the majority of the voting rights of the shareholders of a Luxembourg entity;

- have the right to appoint or revoke the majority of the members of the board of managers, board of directors or supervisory board of a Luxembourg entity and, at the same time, be a shareholder of the entity;

- be the shareholder of a Luxembourg entity and control, through an agreement entered into with the other shareholders of that entity, the majority of the voting rights of the shareholders of the entity; or

- have more than 25% of the voting rights of a Luxembourg entity.

The screening procedure applies to existing investments in a Luxembourg entity that fall within the scope of the Bill following certain operations, such as a share capital increase or the acquisition of additional share in an entity.

Portfolio investments, being investments made for fund placement purposes but which do not enable foreign investors to control, directly or indirectly, the Luxembourg entity, do not fall within the scope of application of the Bill.

Some uncertainties remain as to which Luxembourg entities fall within the scope of the Bill as this is not defined by the Bill. For example, the Bill does not address the specific case of Luxembourg branches established by companies located outside the EU or the EEA when they carry out a critical activity. Although the spirit of the Bill and of the FDI Regulation invite a broad interpretation of the “entity” concept to consider that Luxembourg branches should fall within the scope of the Bill, some grey areas remain when applying the Bill.

What activities are considered critical by the Bill?

The Bill clarifies which sectors are critical for the security, public order and interest of Luxembourg. These sectors are:

- development, exploitation and trade of dual use goods;

- energy: production and distribution of electricity, conditioning and distribution of gas, oil storage and oil trade, quantum and nuclear technologies;

- transports: land, water and air transports;

- water: collection, treatment and distribution of water, collection and treatment of wastewater, as well as collection, treatment and disposal of waste;

- health: healthcare activities and medical analysis laboratories, nanotechnologies and biotechnologies;

- communications: cabled telecommunications, wireless telecommunications, satellite telecommunications, postal and courier services;

- data processing and storage: facilities for data processing, hosting of information services and internet portals, technologies concerning AI, semi-conductors and cybersecurity;

- aerospace: space operations and space resources exploitation;

- defence: activities related to national defence; production and trade of weapons, ammunition, powder and explosive substances for military purposes or war materials;

- financial: central bank activities, infrastructure and systems for trade, payment and settlement of financial instruments; and

- media: publication, audio-visual and broadcasting activities.

It also includes any research, production and associated activities linked to these sectors because it would give access to sensitive information or would give access to places where those activities are carried out.

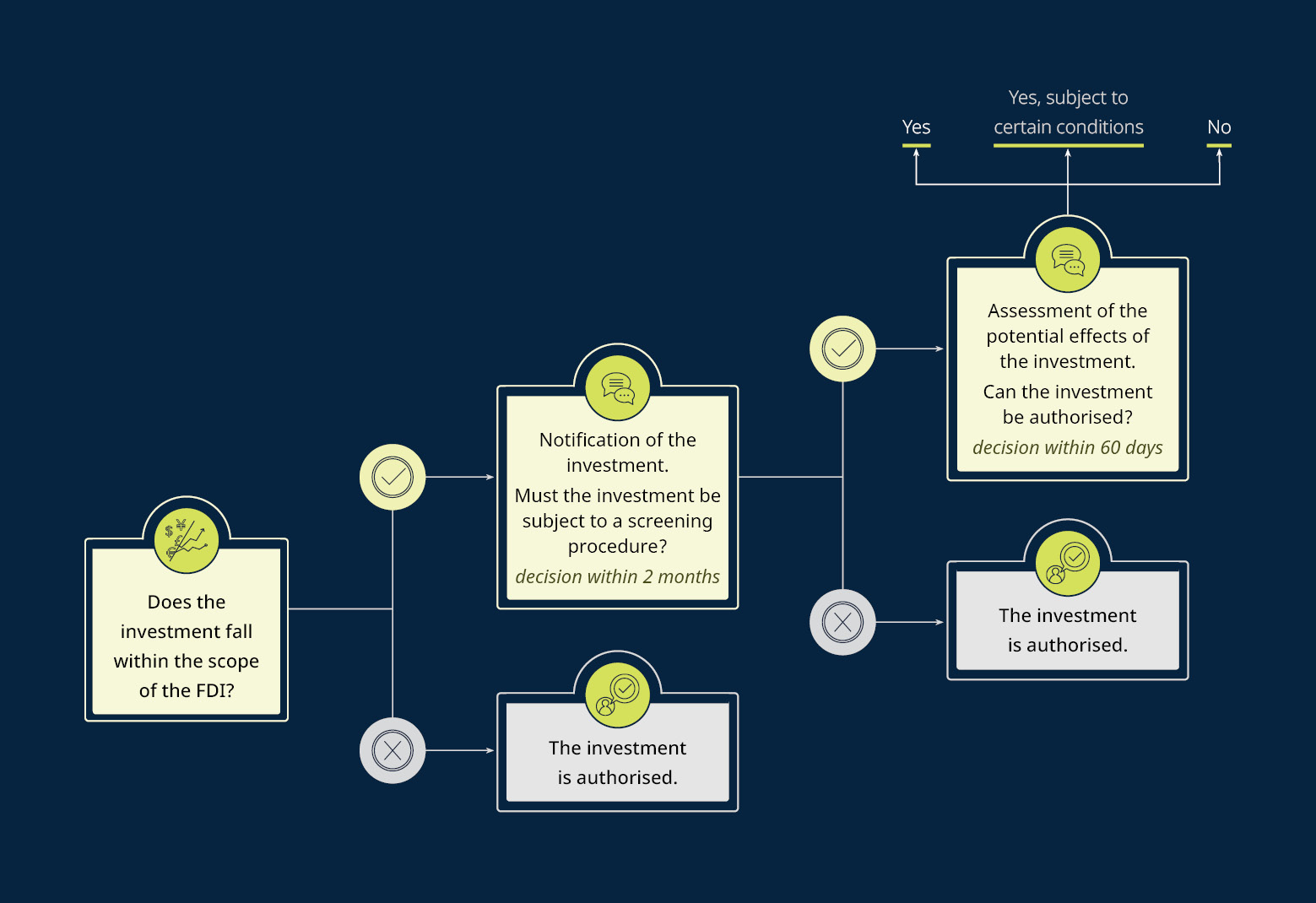

What does the procedure look like?

The Bill provides for a screening mechanism under the supervision of the Minister of the Economy for investments made by non-EU investors looking to invest in specific sectors.

In practice, before completing any FDI falling within the scope of the Bill, the investor has to notify the Minister of the Economy to inform them of the potential investment and provide certain information about it. Within two months from the notification, the Minister will decide if the investment must be subject to a screening procedure. The Minister will assess the potential effects of the investment and, at the end of the screening procedure, which can’t be longer than 60 days, the Minister will inform the investor of their decision. If the investment is authorised, it may be subject to conditions based on the outcome of the screening procedure.

The decision following the screening procedure will be adapted to the specific circumstances of the case and must respect the principle of proportionality.

Any investment realised without observing the procedure would expose the investor to sanctions, including the suspension of the voting rights linked to the investment and/or fines.

The Bill doesn’t say what the deemed decision of the Minister will be if no response is given within the timeline.

What sanctions apply in case of breach of the Bill?

If no notification is made in cases where it was required, the Minister may ask the investor to change the transaction or restore the previous situation at its own expense.

When authorising an FDI, the Minister can provide for certain conditions. If the foreign investor does not comply with the conditions, the Minister can ask the foreign investor to observe the conditions within a certain timeframe, ask the foreign investor to comply with other measures within a certain timeframe (including the disposal of part or all of the activities), or withdraw the authorisation initially granted.

If the foreign investor doesn’t comply with the Minister’s injunctions within one month following their notification, an administrative fine may apply. The fine may be of a maximum of EUR1 million if the investor is an individual, or EUR5 million if the investor is a legal entity.

What will this change for Luxembourg transactions?

Non-EU investors looking to invest in Luxembourg will have to observe the procedure described above. As this is an ex-ante process, it will need to be taken into account to assess the timing of a transaction. In Luxembourg, the decision to authorise the investment following the screening mechanism will be completed within four months from the notification.

While the Bill requires non-EU investors investing in the EU via a Luxembourg company to comply with the local requirements of the jurisdiction where the asset is located, it does not deter Luxembourg's commitment to being an ideal platform for global investors.

These changes might raise some questions. Get in touch with us for any clarifications or assistance you may need. Our team is ready to provide guidance tailored to your specific investment goals and to help you navigate this new regulatory landscape.